ELEVATION REAL ESTATE FUND

Real Estate Investment in the Heart of the Smokies

$5M debt raise for premium townhome developments in Gatlinburg & Pigeon Forge, along with select high-growth opportunities, offering a three-year promissory note bearing interest of 12% per year, payable quarterly.

Targeted 12% Annual Returns | 3-Year Investment | $5M Fund

Investment Highlights

Discover how these strategic advantages support our ability to deliver consistent returns in the Smoky Mountain Market.

Premium Returns

Targeted 12% annual rate for promissory notes raising funds on townhome developments.

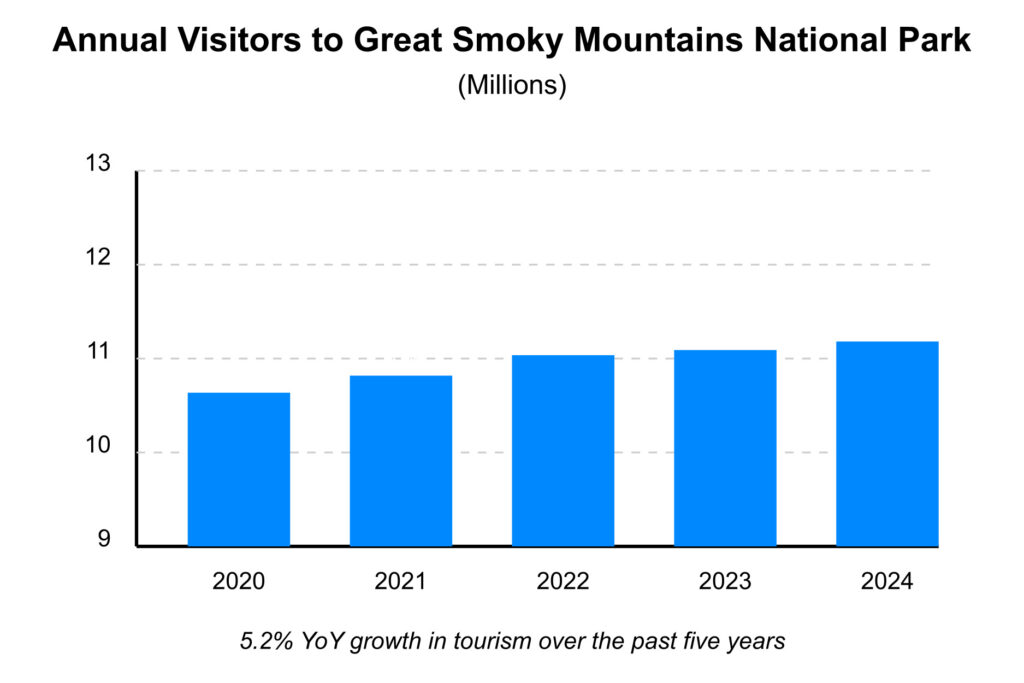

Tourism-Driven Growth

Leverage 11.5M annual park visitors and 5.2% YoY tourism growth for consistent rental demand.

Limited Supply Market

Benefit from mountainous terrain restricting new development while visitor numbers continue climbing.

Strategic Exit Plan

Clear 3-year timeline with multiple exit strategies ensures optimized investor returns.

Gatlinburg & Pigeon Forge

Market Opportunity

Our developments harness the perfect combination of booming tourism, limited supply, and year-round rental potential.

Massive Tourism Market

The Smoky Mountains National Park drives consistent tourism demand to our development locations, creating year-round opportunities.

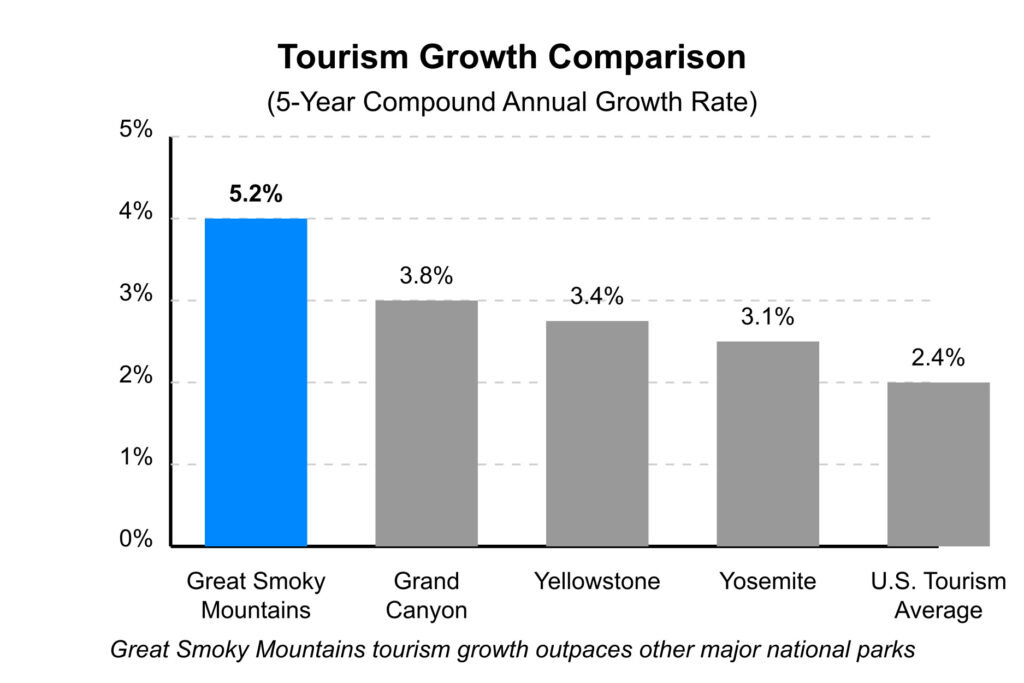

Tourism Growth Comparison

The Smoky Mountain region outpaces other major destinations, ensuring a strengthening market for long-term investment.

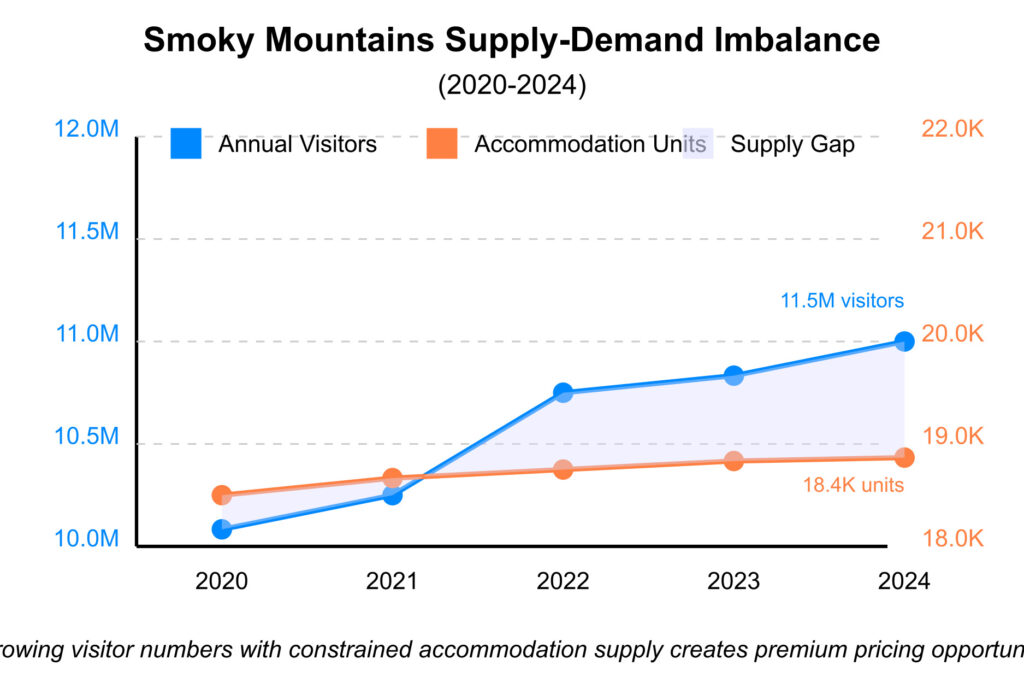

Limited Supply Advantage

While visitor numbers continue to climb, mountainous terrain restricts new development, maintaining high occupancy rates & rental yields.

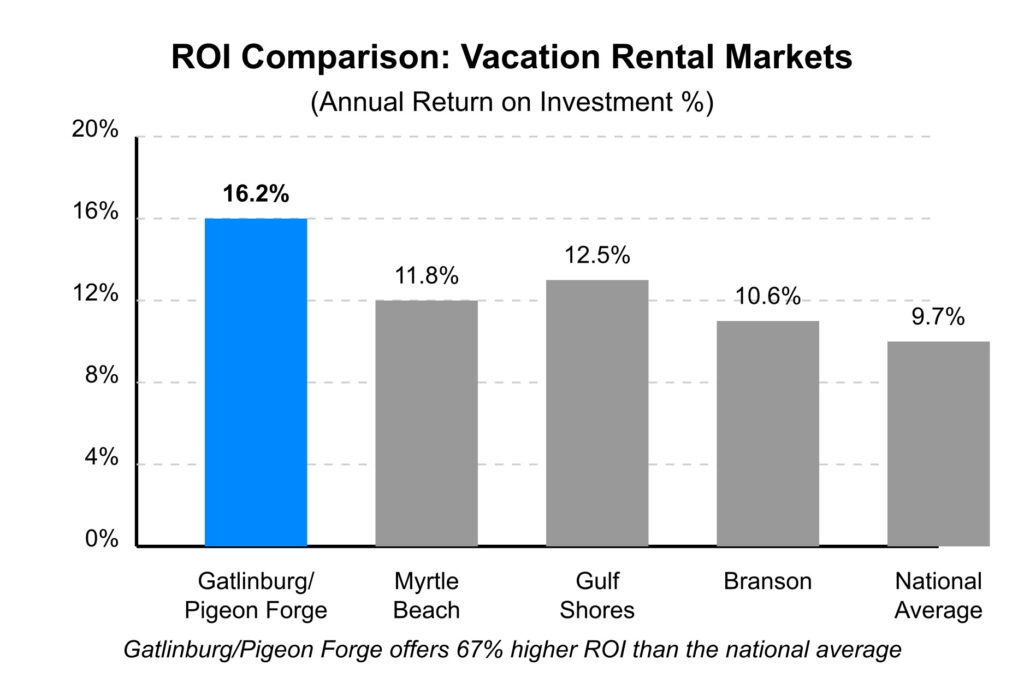

Superior Market Returns

Gatlinburg/Pigeon Forge significantly outperforms comparable markets, providing ample margin to deliver our targeted 12% preferred annual return.

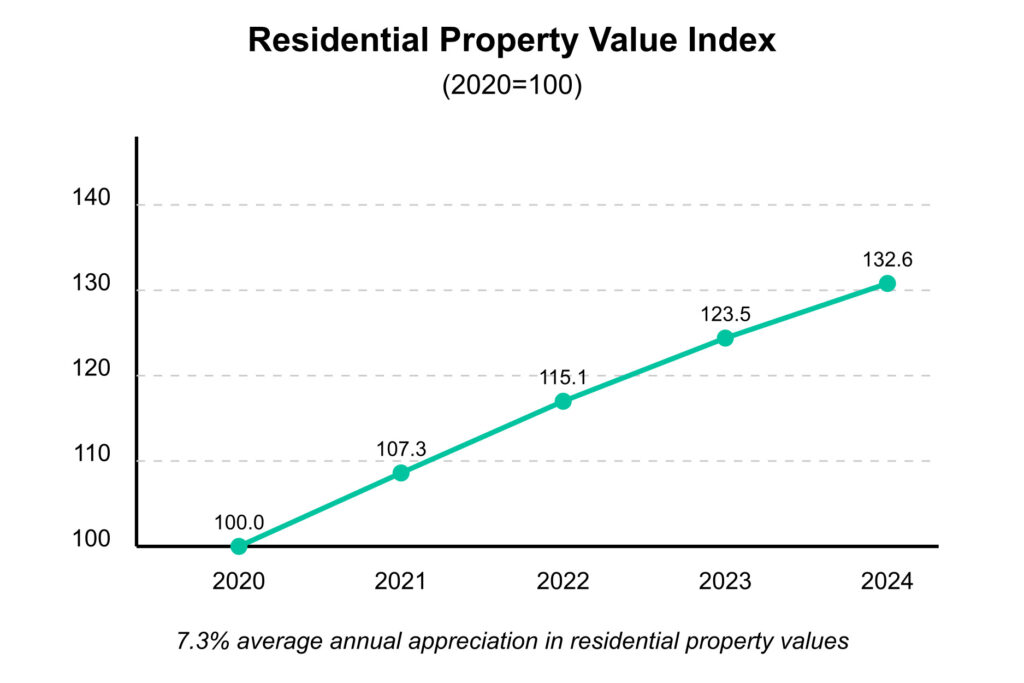

Consistent Property Appreciation

Consistent property value in the region provides built-in appreciation for our townhome developments

Work organization

Featured Townhome Developments

Our strategic investments leverage multiple market advantages that create a compelling opportunity in this high-demand region.

Premier Location, Premium Returns

Exclusive access to our professionally managed townhome developments. These twelve 3-bedroom, 3.5 bathroom luxury townhomes, each spanning 1,880 square feet, offer premium living spaces in the heart of Pigeon Forge – a high demand destination known for its vibrant tourism and growth potential.

$ 0

M+

Projected Revenue

0

%

Projected Profit Margin

0

mo.

Projected Timeline

Strategic Location

Our Nancy Street location balances prime access – minutes from Dollywood, The Island, and the Parkway, while nestled in a quiet residential area with superior travel routes. This strategic positioning captures tourism demand while providing the peaceful setting that vacation guests consistently seek and value.

Proven Timeline

Our 12-14 month development timeline accelerates investor returns through strategic construction phasing and established local contractor relationships. By eliminating common delays and leveraging pre-approved plans, we expedite the journey from groundbreaking to completion and revenue distribution.

Investor Value

Our projects’ average 31% profit margins fully support the targeted 12% promissory note interest rate return, delivering a reliable income stream with strong capital preservation. Conservative financial modeling and strategic contingency planning ensure consistent performance.

Fund Timeline

Fund Implementation & Returns Schedule

Capital Formation

Complete $5M capital raise, finalize architectural plans, secure remaining permits, and assemble construction teams for both projects to ensure immediate execution upon funding.

2025 Q4

Milestone 1

Construction Launch

Break ground on Nancy Street (Pigeon Forge) project, begin pre-sales marketing campaign, and complete final site preparation for Powdermill Road (Gatlinburg) development.

2026 Q1

Milestone 2

Second Project Initiation

Commence construction on Powdermill Road project, achieve 40% completion on Nancy Street development, and reach 30% pre-sales target across both projects.

2026 Q3

Milestone 3

First Project Completion

Finalize Nancy Street construction, begin closing initial unit sales, commence first investor distributions, and reach 80% completion on Powdermill Road development.

2027 Q2

Milestone 4

Full Portfolio Completion

Complete all construction activities, achieve 75% total unit sales, distribute majority of investor capital and preferred returns, and implement final marketing push.

2028 Q2

Milestone 5

Team Members

Meet our team of experts

John Dustin Cole and Travis Vickers lead Elevation Real Estate Fund, LLC, with over 25 years combined expertise in real estate investment, construction management, and strategic development, consistently delivering strong investor returns.

Travis Vickers

Co-Fund Manager

Travis Vickers

Co-Fund Manager

Travis Vickers is Co-Managing Partner of Elevation Real Estate Fund, LLC at Elevation Real Estate Fund, bringing over 10 years of experience in real estate operations, construction management, and project execution. Previously, as a key leader at Southern Specialty Properties LLC and Britts Investment Properties, LLC, Vickers oversaw national foreclosure transactions and pivoted operations to new construction projects in Gatlinburg and Pigeon Forge. His expertise encompasses operational efficiency, construction management, and strategic execution of projects from inception through completion, significantly enhancing investor value.

- Email:[email protected]

John Dustin Cole

Co-Fund Manager

John Dustin Cole

Co-Fund Manager

John Dustin Cole is Co-Managing Partner of Elevation Real Estate Fund, LLC. He brings over 15 years of expertise in real estate investment, specializing in development, capital raising, and financial structuring. Over the past three years, Cole has been the principal at Southern Specialty Properties LLC and Britts Investment Properties, LLC, successfully executing numerous new construction projects and investment strategies in Gatlinburg and Pigeon Forge. His extensive experience includes managing nationwide portfolios, identifying undervalued real estate opportunities, and structuring transactions that consistently deliver high investor returns.

- Email:[email protected]

Secure Your Position

Ready to secure your position in this high-growth townhome development opportunity with targeted 12% preferred returns? Click the “Invest Now” button and follow the simple steps below to join our community of successful investors.

$250 Minimum Investment

Fund Closing April 2026

Review Documents

Review our offering documents detailing the fund’s strategy, development projects, and projected returns.

Sign Agreements

Electronically sign the subscription agreement confirming your investment commitment.

Fund Investment

Transfer your investment via wire or ACH to finalize participation and gain access to our investor portal.

STEP 3

Help Center

Questions? Answers.

Quick answers to questions you may have.

What are Investment Limits for Reg CF funds??

Anyone can invest in a Regulation Crowdfunding offering. Because of the risks involved with this type of investing; however, you may be limited in how much you can invest during any 12-month period in these transactions. If you are an accredited investor (see defi nition below), then there are no limits on how much you can invest. For Non-Accredited Investors (most fall into this category) the limitation on how much you can invest depends on your net worth and annual income. If either your annual income or your net worth is less than $124,000, then during any 12-month period, you can invest up to the greater of either $2,500 or 5% of the greater of your annual income or net worth. If both your annual income and your net worth are equal to or more than $124,000, then during any 12-month period, you can invest up to 10% of your annual income or net worth, whichever is greater, but not to exceed $124,000.

What is an Accredited Investor?

An accredited investor, in the context of a natural person, includes anyone who: earned income that exceeded $200,000 (or $300,000 together with a spouse or spousal equivalent) in each of the prior two years, and reasonably expects the same for the current year, OR has a net worth over $1 million, either alone or together with a spouse or spousal equivalent (excluding the value of the person’s primary residence), OR holds in good standing a Series 7, 65 or 82 license.

How does the online investment process work for this Reg CF opportunity?

After you review the offering statement and information and decide what you’d like to invest and how much, you complete the application with the requested information and electronically sign the documentation.

Andes Capital, the Broker-Dealer, reviews the information for Anti-Money Laundering and Know Your Customer type reviews

– If you pass the review, Andes Capital initiates the funds via ACH or Credit Card (or you send the wire or check if applicable)

– If you don’t pass the review, Andes Capital or the Issuer will reach out to you to update information to clear you for the reviews or otherwise

Once the funds have been cleared by the escrow agent (funds go directly there), Andes Capital will match your funds with your cleared application for investment, and issue you the stock by validating the subscription agreement and notifying the Transfer Agent to record your ownership on the Issuers capitalization table.

The timeline is generally 2 to 4 weeks but can always happen sooner. It all depends on the information you provide and if there are issues, how quickly we hear back from you.

If we bump up against any “hits” on our reviews, we are required to clear each one of those potential conflicts to evidence there are no issues.

If the information provided is not correct or is incomplete, we will need to reach out and get this corrected.

Even though funds are initiated or you see them pending in your funding source, this does not mean they are in the escrow account for the offering. Based on the payment rails available in the US, these funds may not appear in escrow for 1-2 days and then they have to sit there for a few days until the escrow agent is satisfied there doesn’t appear to be any issues

Matching of payments to approved applications happens in batches, so while all ready to be closed, your application may be in the next batch.

Andes Capital Group is the FINRA/SEC registered Broker Dealer who has been engaged by the Issuer to act as the Onboarding Agent for this offering.

Andes Capital Group is NOT soliciting this investment nor making any recommendations by collecting, reviewing and processing your application for investment.

Andes Capital Group conducts Anti-Money Laundering, Identity and Bad Actor Disqualification reviews of the Issuer, and ensures they are a registered business in good standing.

Andes Capital Group is NOT validating or approving the information provided by the Issuer or the Issuer itself.

Contact information is provided for applicants to make inquiries and requests of Andes Capital Group regarding the general application process, the status of the application or general Reg CF regulation related information. Andes Capital Group may direct applicants to specific sections of the Offering Statement to locate information or answers to their inquiry but does not opine or provide guidance on Issuer related matters.

How does Andes Capital Group get compensated?

Andes Capital Group is compensated by the Issuer for providing its Broker Dealer Onboarding Agent services as disclosed in the Offering Statement. Andes Capital Group does NOT charge the applying investor any fees whatsoever.

Am I now a customer of Andes Capital Group?

By investing in an Issuer’s Reg CF offering where Andes Capital Group is the Broker Dealer Onboarding Agent, Andes Capital must ensure that you as the investor, do not breach the SEC’s limits on investing in Reg CF Offerings within a 12 month period. While it’s not a full-fledged brokerage account where we custody your holdings or recommend any investments, you will have an account at Andes Capital to track the investments made where Andes Capital was engaged as the Broker Dealer Onboarding Agent. There is NO cost, charge or no annual fees etc. for this account whatsoever.